Incentive gift card use continues to head in one direction — up. According to the Incentive Research Foundation (IRF) Industry Outlook for 2024, more than half of respondents from North America (52%) anticipate spending more on gift cards for rewards and recognition this year than in 2023. Two key selling points of gift cards for corporate use haven’t changed: choice and ease of use.

- Choice – In a recognition environment in which we’re told personalization is vital, gift cards provide choice — in some instances unlimited choice — while retaining much of the memorability of non-cash recognition categories such as merchandise and travel. Companies that use gift cards control how much choice their recipients have. An open-loop gift card works like a standard debit card and can be used anywhere the supporting financial issuer is accepted. Closed-loop cards are merchant-specific, which provides a program sponsor assurance that the card will be used on something fun.

- Ease of use – Simply put, administration is a breeze. Many incentive gift card suppliers will handle everything for you.

Brand-Specific Gift Card Trends

In 2023, North American corporate use of brand-specific gift cards increased 13% over the previous year, while open- loop cards showed negligible difference compared to the prior year, the IRF reports.

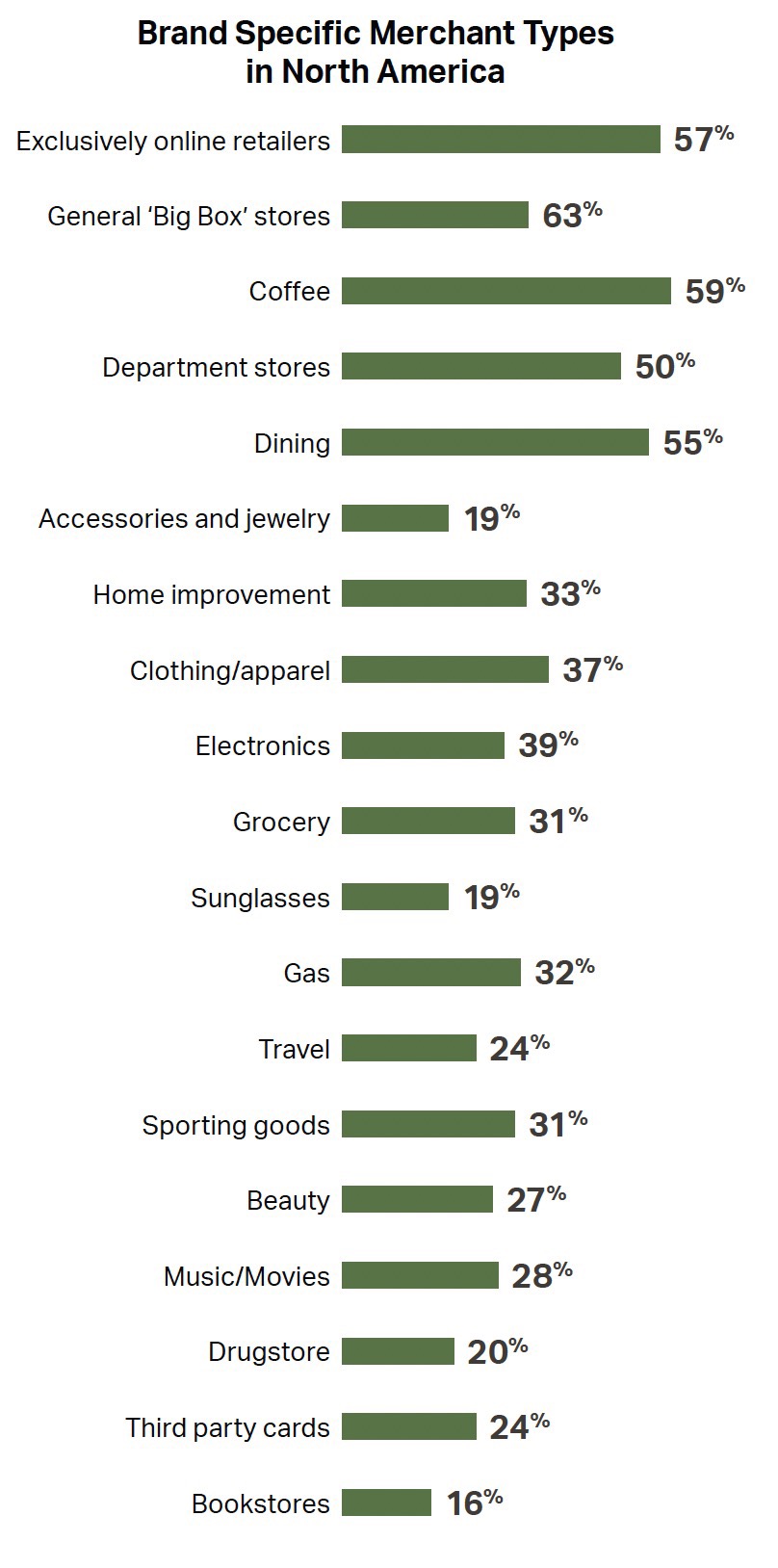

Nearly all brand-specific gift card categories continue to experience participation growth compared to 2022, with minor exceptions observed in sunglasses (-6% vs. the prior year) and accessories and jewelry (-1% vs. the prior year). The utilization of gift cards is on the rise, both in terms of volume and the variety of options available to recipients. The top three categories selected in North America were general “big box” stores, coffee and exclusively online retailers.

The average value for North American recipients of corporate gift card incentives and recognition is $152, according to the IRF report.

New Experiences

Interestingly, a report from Javelin Strategy & Research shows that workers who receive a gift card from an employer are more likely to try a new product or service. Fully 42% of recipients of employee incentive gift cards said they will use it to try something new always or most of the time.

Why does this matter? New experiences can be some of life’s most memorablehighlights. Imagine the loyalty engendered when an employer helps pave the way to such experiences for employees or business partners!

A Better Way to Buy Corporate Gift Cards

For decades, a pervasive trend in corporate gift card use has been their purchase at retail outlets. Despite corporate gift card suppliers offering discounts for bulk purchases as well as all sorts of extra services, end users continue to purchase the bulk of closed-loop cards at retail.

In a presentation on Javelin’s survey findings for the Incentive Gift Card Coalition (IGCC), Jordan Hirschfield, director of prepaid advisory services for the company, reported that approximately 70% of the retailer- specific gift cards purchased for corporate incentive use were physical cards.

This may be a reflection of the habit of purchasing cards from retail outlets. When buying in bulk, end users would be better served buying from an incentive gift card supplier. The IGCC is a useful resource for finding those suppliers.

The Javelin study showed that when companies purchase digital gift cards, the value per card averages about $10 more than physical cards ($115.43 vs. $95.33).