By the time you read this, we’ll have been in some form of “lockdown” for months. Some cities are becoming less restrictive, but the economy has a long way to go before we’re feeling prosperous. At InsideView, we’ve been helping customers find unexpected opportunities by using a variety of non-typical data signals. I’d like to share what’s been working to help others find their way.

Who is your new target?

For many companies, their ideal customers are no longer ideal as they freeze budgets and put initiatives on hold. These companies need to find new buyers for their products and services. Unfortunately, the massive market changes have left their customer and prospect data almost worthless, because it no longer reflects the real world. This is the data they would typically turn to find new companies and people to target. It’s a perfect storm, leaving many businesses unsure of where to turn.

In such a crisis, companies can hunker down and hope to outlast the storm, or they can learn to ride the wave and find opportunity in its midst.

Figuring it out

If your “ideal customers” are struggling in the wake of Covid-19, the last thing you want are more prospects that look like them. You need to redefine your ideal customer profile (ICP) and find new target companies that are experiencing increased demand. I’ll step through the process we use.

Step 1: Filter on industries and sub-industries

A good place to start is to look at industries, or more specifically, sub-industries, because there can be wide variation within a single industry. Think about the Hospitals and Healthcare industry, for example. Hospitals that service elective procedures are all but closed for the time being, and when they reopen will likely be operating at reduced capacity. These would likely not be good targets at this time. On the other hand, those that provide essential services are busier than ever and are in need of many new products and services now.

In working with our customers, we start by building lists of new target companies using industry and sub-industry filters.

Step 2: Refine based on other ICP characteristics

Next, we refine the list using characteristics from their old ICP that are still relevant, despite the pandemic. These characteristics might include employee count, revenue, location, technology profiles, specific job titles, and such.

Step 3: Zero in based on news events

Even within sub-industries, some companies will be thriving while others may be in a holding pattern. How do you know which to target? We advise our customers to filter their list further based on recent news.

While many types of data will be unreliable at this time, the news is not. It tells us a company’s current state of affairs. To find healthy, growing companies look for news that indicates:

Expanding operations

Funding developments

Hiring

New offerings

Outperforming

On the flip side, you may want to weed out businesses that are in the news for:

Bankruptcy and restructuring

Underperforming

Cost-cutting

Layoffs, furloughs, or reducing workforce

Armed with a new list of targets, you’ll need to consider how they will use what you offer.

Reimagine your product-market fit

In tandem with redefining your targets, you’ll likely need to reimagine how your products can be used to meet the needs of these new targets. Let’s look at some examples.

PODS, who traditionally targets individuals and businesses that are moving locations, has reinvented their Portable On Demand Storage (PODS) units to meet a timely need for an entirely new buyer. In collaboration with the Army Corps of Engineers, they have retrofitted their PODS into popup patient isolation rooms that hospitals can use to create extra capacity during Covid-19. Their PODS are also being used as triage units outside small urgent care centers, decontamination rooms, and more.

SafeGraph is another terrific example. Their typical buyer is a business analyst or line-of-business leader who wants to do such things as analyze retail and real-estate traffic, improve location-based marketing, and do store visit attribution, among their many use cases. But they are currently offering their geospatial data to researchers and organizations, including the Centers for Disease Control, to measure the efficacy of social distancing and stay-at-home orders.

My final example is Enterprise Rent-a-Car. They are shifting from their typical travel buyers to retailers who need additional cars to meet the growing demand for delivery services.

Now it’s your turn to get creative.

Revisit your data

The other thing we’ve been telling our customers is that it’s more important than ever to manage their customer data. Specifically, the information typically stored in your customer relationship management (CRM) system on accounts and people.

Prior to Covid-19, a frequently quoted stat is that as much as 70% of B2B data decays in a year.* Imagine how much faster it’s decaying today, with the upheaval and turnover in the market. Account information is going to be inaccurate, and information on the people will be even worse, given the level of unemployment.

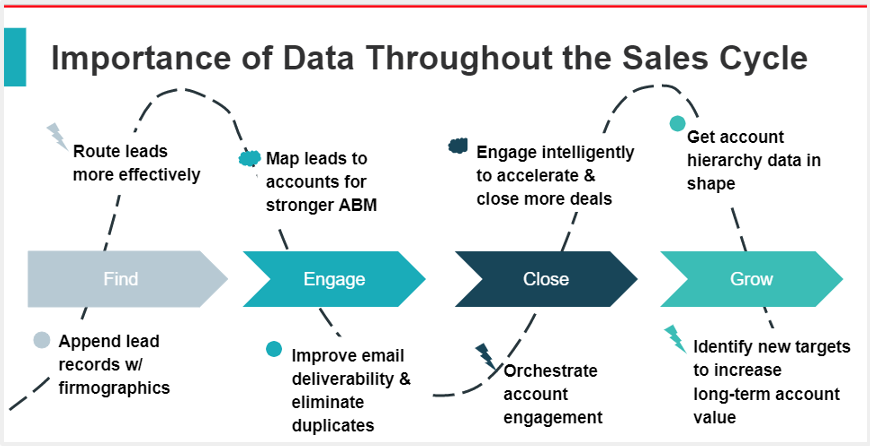

The impact of improving this data quality is seen at every stage of the sales cycle, as shown in this graphic.

You need reliable industry and firmographic data to find your new targets. You’ll need current people data to find decision-makers who are still working at those companies, as well as current email addresses and phone numbers to connect with them.

You won’t be able to trust LinkedIn profiles for a while, because people rarely update their profiles when they’ve been laid-off or furloughed. They wait until they land somewhere new.

The reason I’m drilling in on this is that most companies say data management is important. In fact 70% of sales and marketing leaders say it’s a high priority, according to a recent study we completed. Yet few do anything about it. A shocking 65% either manually clean their data or do nothing at all to keep it up-to-date. And that was before the pandemic.

Companies need to focus on their data management now. Find the best new targets. Improve sales efficiency. Get more yield from your precious marketing dollars. Help your own customers pivot.

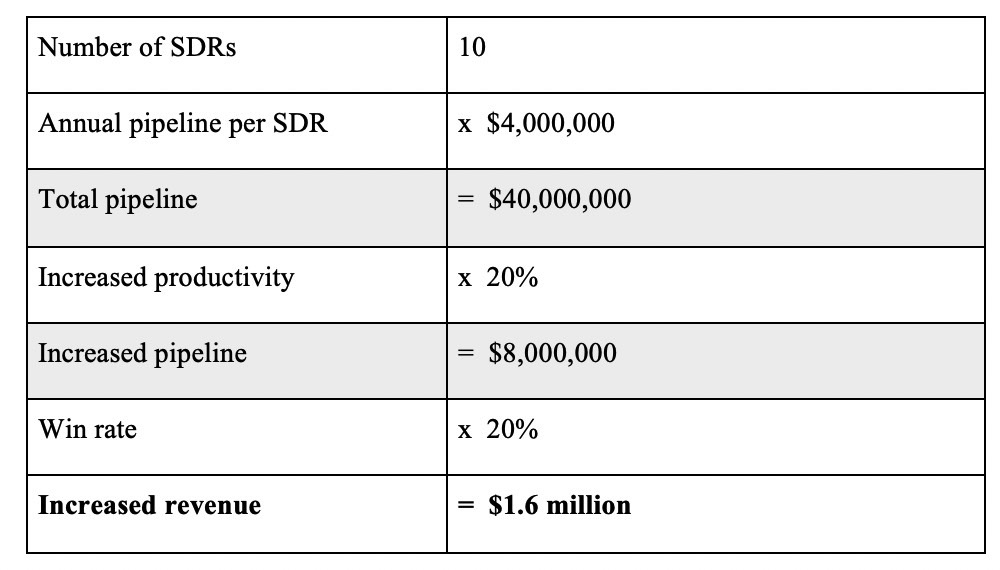

And if that argument wasn’t enough, here’s an example of the kind of return-on-investment you might get to help build an argument for spending resources to make your own data better.

Calculate the value of improving your own CRM data

How much more pipeline — and ultimately revenue — could your sales development reps (SDRs) generate, if they could save 20% of their time currently spent cleaning up lead data?

What data management does:

Automatically enriches inbound leads, and cleans, enriches, and flags duplicates in your CRM data.

How it helps:

With higher quality data about your leads and less dirty data “noise,” your SDRs will:

Significantly reduce the amount of time they spend researching leads to eliminate duplicates and fill in missing information

Better understand their prospects for more relevant engagement

Be able to devote more time to generating pipeline.

It’s easy to feel overwhelmed when the world is spinning around you and you can’t anchor yourself on the guideposts that typically point the way. But there are signals out there that can steer you through this storm. You just need to know what to look for and how to manage the data you have.

Umberto Milletti is CEO and Founder of InsideView, a CRM intelligence company.