In this post, I’ll focus on metrics for the sales force, prospect development and opportunity management.

The best use of metrics is to:

- Determine that things are progressing as they should (or not)

- Know where to drill down to diagnose root causes

- Allow you to take corrective action.

- Sales Productivity

I most often hear sales productivity defined as “revenue per rep.” I prefer “the output of the sales force over a given time” (which can be a total or an average). It’s a complex metric to benchmark, so it’s most important to track how your productivity is trending. If required, what diagnostic and corrective actions will you take?

Sales Velocity

Sales velocity is like the mph of a sales force – it’s the speed at which a sales force drives revenue.

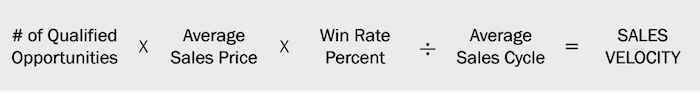

Looking back over a defined period, here’s how you calculate Sales Velocity:

With the above formula, you can drill down into the number of opportunities, deal size, win rates, and sales cycle, to find ways to improve velocity. Tip: Use qualified opportunities. Unqualified opportunities are just noise.

You can calculate the sales cycle in days, weeks, or months or calculate velocity for products, the company, team, or individuals. This flexibility is valuable in making comparisons. I recommend using sales velocity to identify where improvement is needed and where to probe more deeply.

Prospect Development Metrics

If you are using marketing automation or a sales engagement platform, you’ll have endless possibilities for tracking the effectiveness of your prospecting sequences through email, phone, and LinkedIn.

Whether or not you have these tools, I’d recommend tracking:

Lead Source and the conversions between the Initial Sales Conversation and the first Discovery Session

Conversion ratios for:

- Sequences that produce Initial Sales Conversations (to set an appointment)

- Initial Sales Conversations to the first Discovery Meetings

- Initial Sales Conversations to Qualified Opportunities

- Discovery Meetings to Qualified Opportunities

Use the Buyer Engagement Content shared during prospecting to correlate content to conversion to know what is working best. If you’ve built your content to address decision criteria by persona, track it that way, too.

Opportunity Management Metrics

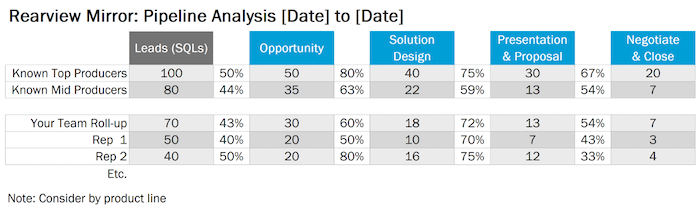

For pipeline management, most people use leading indicators to better manage deals in motion, and those reports are practical. I’d like to share a report I’ve used for diagnostic purposes, to unearth data-driven insights about where to explore further to improve sales performance. This report is tricky to develop but worth the effort. The metrics examined are the number of opportunities per sales process stage and the conversion ratios between stages.

Build around process: Start with your process stages, the number of opportunities per stage, and the conversion ratios between them.

Pick a time frame to examine: I look back two to three times the average sales cycle. With short cycles, perhaps further; with longer cycles, less.

Consider segmenting: Sometimes, I segment by product line based on the variation of the sales cycle by product.

Create benchmarking groups: Identify a group of known top producers (such as the top quintile) and gather their results. Do the same with the middle quintile of average/mid-producers.

Determine reporting structure: Create the report for managers and their sales reps. You can create other roll-ups, but the front line sales manager reports are the most practical.

With the report built, managers can compare their reps to their teammates and the mid and top producers. They can evaluate the number of opportunities per stage as well as the conversion ratios between stages. This report won’t help manage the current pipeline (although, interestingly, it can point out where to spend more time with reps’ current opportunities). It will, however, expose areas of strength and for improvement. This helps managers identify peer coaches or mentors as well as where they should focus to lift their team’s performance. We recommend this report in our Sales Coaching Excellence™ course for this exact reason.

Uncover Problems and Learn Where to Drill Down

In addition to the above report, there are dozens of pipeline metrics you can track.

Remember, the strategy is to identify that things are going as expected or uncover problems and learn where to drill down to find a root cause. Separate from the historical pipeline analysis report mentioned before, other pipeline reports I’ve found helpful for this include:

The standard fare: First Appointments Run, Opportunities Qualified, Proposals Made, and Deals Won/Closed.

Stage-to-stage conversions: Like the Rearview Mirror report above, but also including the relationship between each stage and the outcome.

Time in stage: If you correlate this measure to outcomes, it can help predict when deals are likely to stall or end in No Decision status unless you take decisive action.

Qualification scores: Whatever qualification system you use, having some way to track how well deals are qualified can radically improve pipeline quality and forecasting accuracy (if managers probe for details behind the scoring).

Content Effectiveness: Like in Prospect Development, track the Buyer Engagement Content usage and correlate with sales process progress.

Next Steps

You must decide what’s suitable for your company, in your vertical, with your ICP and market, and your products and services.

Gather the metrics you currently track and brainstorm all the others you think you might need. Then, think “diagnostically” and organize them in tiers:

- Tier 1:The dashboard metrics you need to run the business – the leading and lagging indicators that you need on a daily/weekly/monthly basis.

- Tier 2:The next tier of metrics you need below those (the drill-down metrics), when the dashboard-level metrics indicate a problem you want to dig into. These are the metrics to improve the business.

- Tier 3:The sidebar metrics you need for something specific, such as tracking performance milestones for new-hire onboarding (assuming some are different from Tiers 1 and 2).

- Tier 4:The “put them on the back-burner” metrics that you may need to explore further than the Tier 3 level. If the rare need arises, you can put these into play.

This approach should allow you to solidify and evolve your measurement strategy to include the