So Just What Is Sales Equity?

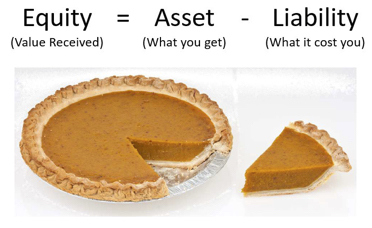

To borrow a phrase from the financial industry, “equity” (the value you receive) is simply your “asset” (what you get) minus your liability (“what it cost you”):

Imagine a pie. The pie represents the total value created by you and your buyer working together. You’d like to get a slice of that value – get paid – as compensation for your efforts. The buyer’s equity, the value they actually get (the amount of pie they take home) is therefore their “asset” (the size of the total pie) less their liability (the slice they give you). It stands to reason then that if the buyer perceives a big pie, the slice you take doesn’t seem too onerous; conversely if the buyer perceives a small pie then giving you a slice can become quite contentious.

The win–win solution is clearly where you both walk away with a lot of pie, and the way to do this is to grow the perceived size of the pie. So let’s start by breaking down a buyer’s perception of the pie into three integrated “equities”: Product Equity, Brand Equity, and Sales Equity.

· Product Equity: The tangible and intangible value a buyer receives from their perception of the product/service “asset”, including technical specifications, quality components and construction, functional performance, design, fit-for-purpose, etc.

· Brand Equity: The tangible and intangible value a buyer receives from their perception of the brand offering the product or service (its name and symbols), including how well known, history of taking care of its customers, social acceptance, risk factors, etc.

· Sales Equity: The tangible and intangible value a buyer receives from their perception of the relationship they have with the sales and account service teams, – seller relationship, including, their reliability, skills, ability to advise the buyer, communication style, etc.

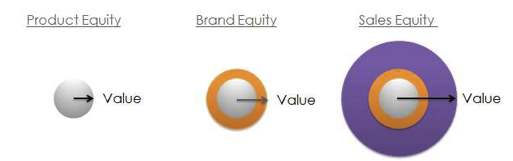

Think of these three integrated equities as concentric rings, building upon each other to grow the perceived size of the “value pie”.

If your buyer only perceives the product equity (e.g., focusing solely on the product/service features) then you have likely created a fairly small “value” pie and you’re going to have to fight like hell for your slice. In the mind of your buyer there just isn’t that much pie to go around.

If you can convince your buyer that the product also has some brand equity wrapped around it, you’ve grown the perceived size of the pie and therefore you can take your fair slice and your buyer still ends up with more pie.

Yet look what happens when the buyer perceives the value trifecta of product, brand, and sales equity. Your buyer perceives a big pie and you’re able to grab a hefty slice of that pie and still leave a plenty of pie (value) for your buyer. A win-win solution.

When you earn high levels of sales equity, buyers:

· Seek your advice

· Give you benefit of the doubt

· Share info to help you win

· Refer others

And that’s not even the best part! In our research, we see buyers with whom you’ve earned high levels of sales equity:

· 4 times higher tenure (Retention)

· 3.5 times share of spending (Expansion)

· 9 times the “First Call and Last Look” on new business (Acquisition)

Depending on your industry, as a general rule of thumb you must excel at creating one of the three equities while being competitive in the other two. For instance:

· For pure commodities, think product equity. If you’re selling corn, you’re usually selling it by the barge load. It doesn’t matter whose farm it came from. There’s no brand equity there; it’s only corn. And it doesn’t matter who the barge operator is; there’s no sales equity there. Your corn needs to be fairly priced because you’re not getting paid extra for having a popular brand or a great barge operator. It doesn’t make sense for the corn farmers to try and get chummy with their buyers. In commodities you need to excel at product equity.

· For Business to Consumer (B2C), think brand equity. Most consumer products companies have figured out that their focus should be on brand equity. It doesn’t make sense for Coca-Cola to spend time and money building 1:1 relationships with their consumer base… all six billion of them. Coca-Cola is selling a common product to billions of people. Economically speaking, any one individual buyer is not that valuable to them. That’s the way it is for most B2C companies. Make the product, market the daylights out of it, and hope people will line up to buy it in stores, online, and over the phone. In B2C you need to excel at brand equity.

· For Business to Business (B2B), think sales equity. In the B2B arena, customers don’t line up to buy stuff. If they did, we wouldn’t need salespeople. We’d just launch a “1-800-Buy-Stuf” phone number and make our quota in no time. In B2B industries, buyers need to be actively sold. The reason we need salespeople in B2B is because in most cases, there are no one-size-fits-all shrink-wrapped products. Individual B2B buyers require tailored solutions, and they need a knowledgeable person to help them understand how a product or service is going to work for them. They need to be able to trust the person sitting across the table from them. There is complex decision-making going on, with many people having to sign off. And in contrast to B2C companies like Coca-Cola and its individual consumers, in B2B there is a high dollar value per customer. In B2B you need to excel at sales equity.

Of course these are just rules of thumb. Even companies like Coca-Cola have a number of valuable, important 1:1 relationships that are worth the effort it takes to build sales equity. Yes, the sales team at Coke shouldn’t care about me, Tom Cates, individual soda drinker, because at best I’m worth $100 a year to them. On the other hand, if I were the Chief Soft Drinks Buyer for Wal-Mart, then Coca-Cola should care very much about what I think. Because my individual value has suddenly gone sky high, they should start trying to tailor a solution just for me, and work very hard to build sales equity.

Tom Catesis founder, CEO and Chief Storyteller of salesEQUITY, the first B2B platform that uses a proven quantitative methodology to measure and assess client relationships.Tom has over 15 years of experience leading consulting engagements focused on the customer-facing elements of sales, marketing and customer service functions in a wide variety of industries. Follow him @salesEQUITY.